City's Reserve System Explained In Presentation

Moose Jaw's capital reserve system has saved City taxpayers $120,000,000 since their inception in the 1950's finance director Brian Acker told Executive Committee.

The reserves produce about a $3,800,000 benefit (at their present interest rate) to the City and without that contribution property taxes would need to rise 13 percent to cover the shortfall, he said.

Those were just some of the facts revealed when the finance director gave a detailed presentation on the City's reserves - which in 2018 totalled $88,525,664.

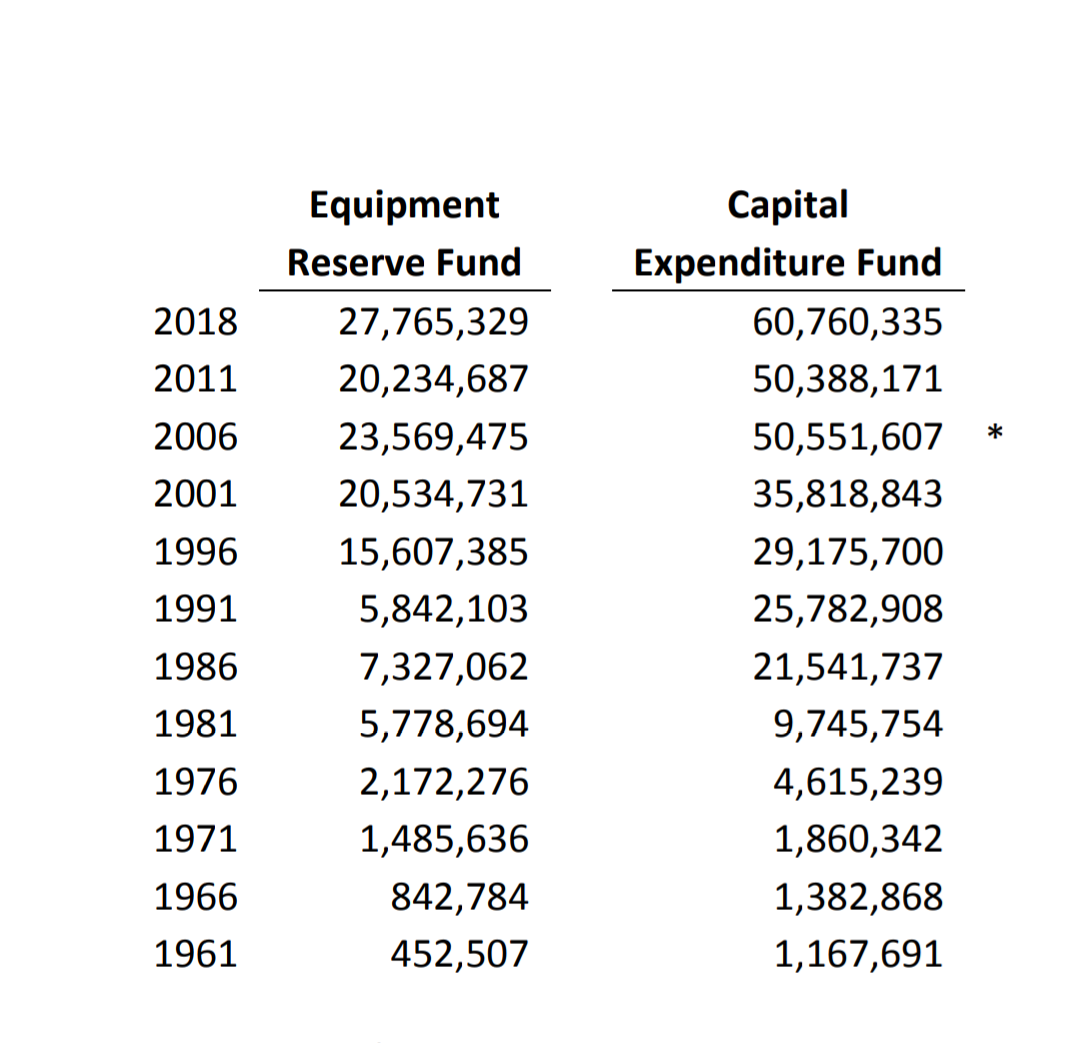

Although the reserves are held in many separate dedicated reserve accounts they are set aside in two basic funds - the Equipment Reserve Fund of $27,765,329 and the Capital Expenditure Fund of $69,760,335.

The growing value of the City's Reserves - source City of Moose Jaw

The City's philosophy for the reserve funds is that by saving money and acquiring interest for a scheduled capital or equipment purchase the end cost to taxpayers is cheaper.

Many other communities in the province do not have the reserve structure the City of Moose Jaw has.

“The basic rationale for the City reserve system is that it is better to save and earn interest for regular capital projects than it is to borrow and pay interest for those projects. ”

Acker spoke about the two types of financing available for expenditures - Pay As You Go and Debt Financing. Both have different positives and negatives impacts.

Pay As You Go Financing is paying for capital projects/equipment from current revenues and reserves.

Debt Financing involves borrowing money for capital projects/equipment purchases.

Pay As You Go Financing for the City entails establishing reserve funds and then over time setting aside funds for the capital/equipment purchase. The positives of this approach is interest from the reserves contributes to the capital project or equipment purchase.

Debt Financing means money is not set aside but it is borrowed with the city paying interest to a lender.

The City uses a combined approach to financing capital expenditures.

Pay As You Go Financing is used for regular and routine capital expenditures whereas Debt Financing is used for non-routine capital expenditures of a serious nature and capital expenditures of a very large nature.

An example was given on how the Equipment Reserve by utilizing the Pay As You Go Financing approach reduces the cost of purchasing a new replacement grader costing $250,000 by tens of thousands of dollars - assuming a six percent investment return rate - versus Debt Financing.

Source - City of Moose Jaw

The Pay As You Go Financing approach saw City coffers contributing $152,000 and interest earned at six percent over 15 years making up the difference of $98,000 for the $250,000 grader.

The Debt Financing option approach would end up costing taxpayers $276,171 for the same $250,000 grader.

The bottom line is the Pay As You Go Financing approach would cost taxpayers $152,000 while Debt Financing would cost $276,171 for the $250,000 grader in the interest scenario presented.

Another example would be a $15,000,000 million capital project where the Pay As You Go Financing would cost taxpayers $9,288,000 due to the Rate of Return and investment income earned. While Debt Financing the project would cost taxpayers. $19,698,262 a difference of $10,410,262.

The Capital Expenditure Fund Equity is a self sustaining reserve fund totalling $36,922,713 and used for non-utility capital works budgeting.

To prevent reserves from losing purchasing power over time the inflation component is invested back into the reserve on an annual basis. Not following this practice would result in a short term increase in investment earnings but over the long term the fund would lose buying power.

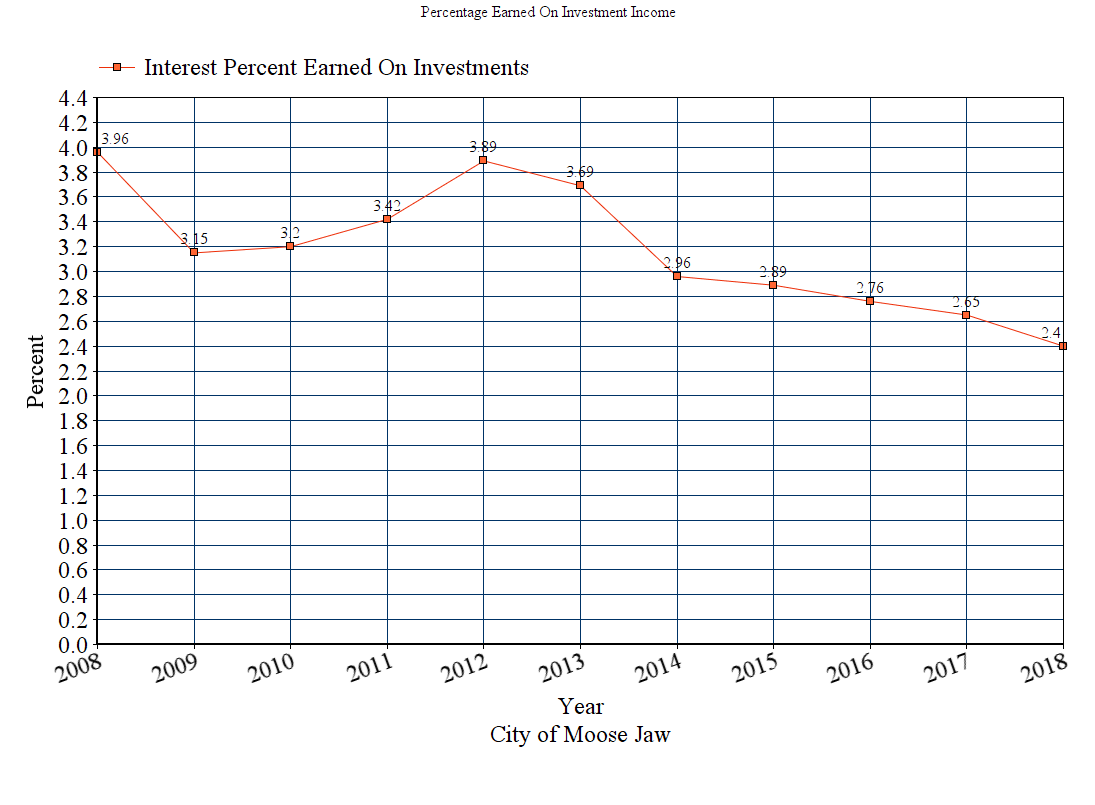

The Rate of Return (interest percentage) by reserves has been decreasing over time whereas the amount earned has increased due to the increasing value of reserves.

The fund is used for a variety of capital expenditures over the long term.

In 1990 the interest the City's reserves earned was 11.67 percent whereas in 2013 the interest earned was 3.69 percent and in 2018 the return on all funds (not just investments) earned 2.40 percent.

In 1990 the actual dollar amount earned from investing was 2,818,300 while in 2013 the City coffers benefited from $3,555,813 in investment earnings. No dollar amount for investments is available for 2018.

The red line on the chart below shows the decreasing percentage-wise return on investments. It needs to be noted the years 2014 - 2018 inclusive show the returns for all funds and not just investments.

The percentage rate (Rate Of Return) earned by invested reserves from 2008 - 2018. Please mote 2014 - 2018 inclusive show the total return of all finds and not just investments.

To help alter the downward shift in the percentage and amount of interest earned Council established an Investment Committee in 2019 to better and more efficiently manage the reserve investments.

The committee is hoping to increase the $3,700,000 earned now to $5,500,000 through reviewing the City's investments and then, through a money manager, re-investing in potentially higher paying returns. Previously the City invested in blue chip bonds as an investment policy.

The change in the investment strategy has proven controversial for some on Council due to the move away from low risk to higher risk investment instruments and higher potential to lose money.

The report also stated if the City could raise its Rate of Return by two percent annually the proceeds generated would be $2,900,000 or the equivalent in 10 percent in municipal taxation.

Concluding his report Acker requested the reserve practices should be formalized into a bylaw providing a permanent and transparent framework for the management of reserve funding and financing.