Residential Property Taxes Set To Increase 5.44 Percent

By Robert Thomas

If you were hoping to get a break when it comes to inflation and your property taxes you’re out of luck.

The percentage increase you pay for residential property taxes on your home is once again headed upwards this year breaking the five percent barrier.

At Monday’s meeting of Executive Committee - in a 6 - 1 vote - the committee decided to raise residential property taxes by 5.44 percent. Councillor Kim Robinson was the lone voice in opposition.

City of Moose Jaw finance director Brian Acker presents the 2023 tax policy to Executive Committee - MJ Independent photo

Coincidentally residential property tax increase closely mirrors the Saskatchewan Consumer Price Index increase of 4.9 percent from March 2022 to March 2023.

The effective property tax increase across all property classes is 4.62 percent but the reason for the higher residential property tax increase is due to the City’s tax policies.

The tax policies are different rates for the three main property classes - agricultural, commercial/industrial and residential.

The City’s policy for agricultural land is to match the mill rate set for the RM of Moose Jaw. Agricultural land is taxed at a rate less than residential and commercial/industrial properties by the City.

When it comes to commercial/industrial properties the City has adopted a “tax fairness” or tax sharing approach.

Comparison of residential property rates in Saskatchewan. Moose Jaw has the fifth lowest residential property rate in the province - City of Moose Jaw graphic

What is Tax Fairness?

Adopted by the Council of the day in 2018 “Tax Fairness” was a campaign launched by the Canadian Federation of Independent Business (CFIB) to see commercial and residential properties taxed at the same rate.

For example, $100,000 of assessment on commercial property would pay the same amount of property tax as residential property likewise assessed for $100,000.

In response to pressure from the local business community the City has moved to reducing the differences in what is paid by commercial property owners and residential property owners for the same amount of assessment.

In 2018, when the policy was adopted, commercial property owners paid property taxes 2.43 times what residential property owners paid for the same amount of assessment.

This year due to shifts in the Province’s rate factor as well as the City’s to share the property tax load from commercial to residential properties has seen the differential paid on commercial properties slip to 1.86 times what residential property owners pay for the same amount of assessment.

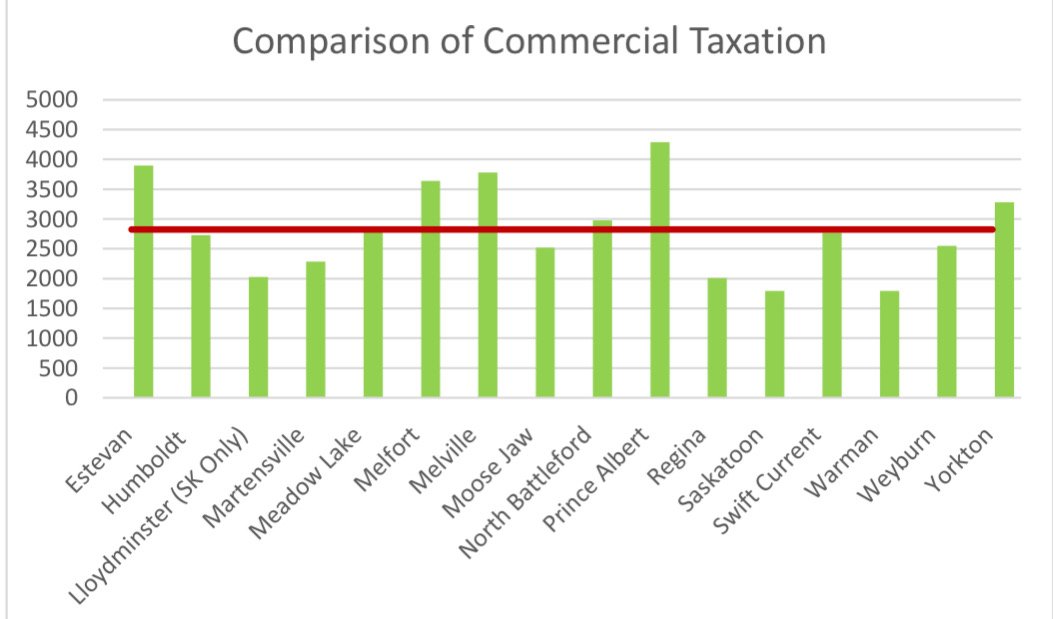

COMPARISON OF COMMERCIAL PROPERTY TAXATION IN SASKATCHEWAN’S LARGER URBAN CENTRES SHOWS MOOSE JAW’S COMMERCIAL PROPERTY RATE THE SIXTH LOWEST PROVINCIALLY - CITY OF MOOSE JAW GRAPHIC

The resulting shift of the City’s property tax fairness or text sharing sees the percentage increase in commercial property taxation to 3.01 percent.

Impact Of Commercial Assessment Appeals

The amount of successful commercial property appeals has led to an assessment loss of 1.20 percent or $8.67 million.

The 1.20 percent lost in commercial appeals amounts to approximately $135,000 Acker told the committee.

He went on to say in 2022 the City could move away from its long-held policy whereby assessment losses within a property class is paid by all members in the class.

The reason the City could move away from charging commercial property owners the assessment loss surcharge is the tax dollars brought in from a larger commercial property assessment class was sufficient to fund the $135,000 property tax lost.

For 2023 Administration was recommending a 1.20 percent surcharge to all commercial properties based upon the expected commercial property tax assessment losses.

SAMA Changes Its’ Way

Acker said the predicted commercial property, tax assessment loss is based upon the Saskatchewan Assessment Management Agency (SAMA) making changes to classes in commercial/industrial and what their assessment is based upon.

Acker said it was SAMA’s way at looking at and addressing cap (capitalization) rates charged after concerns were raised by owners of local business properties.

He said the changes to the capitalization rates will be revenue neutral with the same amount of taxes being collected from commercial properties but taxation now shifting between properties.

“Some of the retail areas are going down as we hoped, and some of the higher quality (office spaces) are going up,” he said.

“This is SAMA’s attempt looking at cap (capitalization) rates.”

Acker said SAMA’s move on capitalization rates is not perfect but the “ assessment changes made by SAMA seem to be in the right direction.”