Report Warns Committee Growth To Noticeably Drop In 2023

By Robert Thomas

It is part of the fine print most people do not read when they review and sign documents but the most recent report from the City of Moose Jaw contains a financial disclaimer which may have those seeing the glass half full to change their opinions.

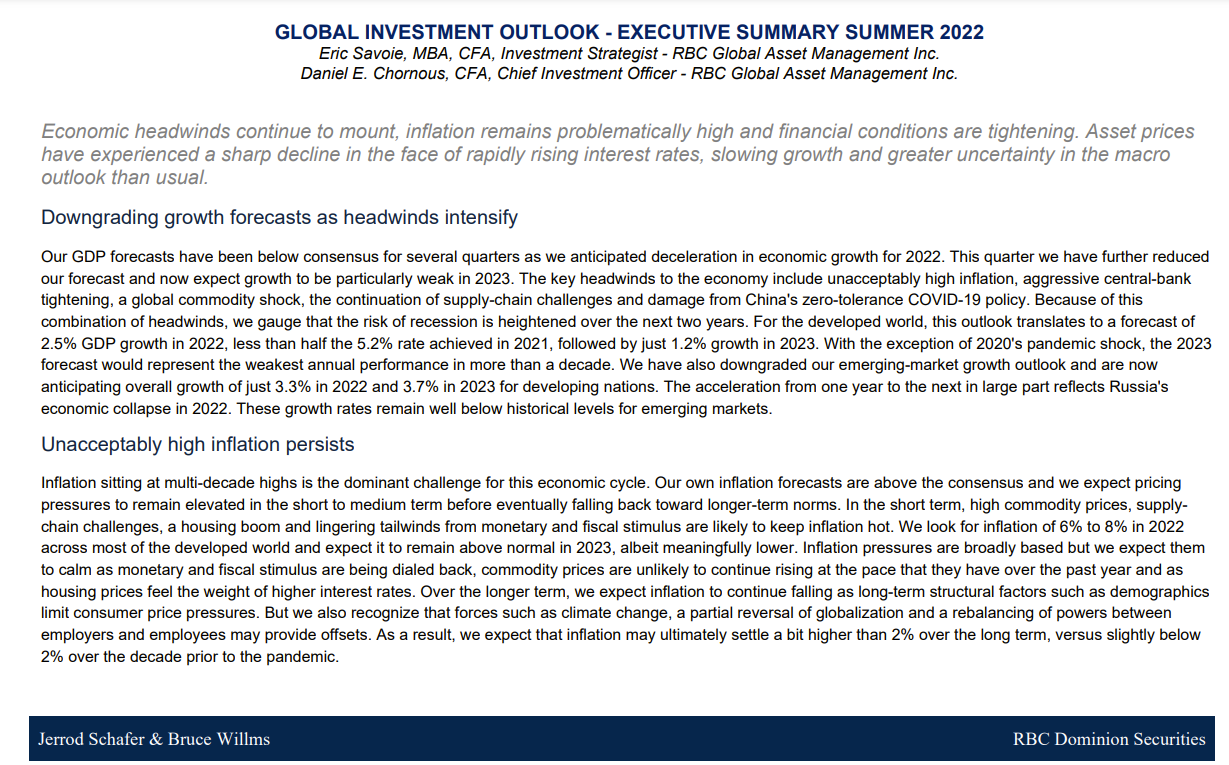

In the report prepared by Eric Savoie, MBA, CFA, Investment Strategist and Daniel E. Chornous, CFA, Chief Investment Officer from the Royal Bank of Canada’s Global Asset Management Inc for the City’s Investment Committee there is a warning that 2023 may not be the brightest year economically.

“Our GDP forecasts have been below consensus for several quarters as we anticipated deceleration in economic growth for 2022. This quarter we have further reduced our forecast and now expect growth to be particularly weak in 2023,” the report’s authors wrote.

Excerpt from report to the City’s Investment Committee predicting drop in GDP in 2023 - source City of Moose Jaw

The report states “unacceptably high inflation, aggressive central-bank tightening, a global commodity shock, the continuation of supply-chain challenges and damage from China's zero-tolerance COVID-19 policy” would, in the developed world, lead to a predicted 2.5 percent increase in the Gross Domestic Product (GDP) down from the 5.2 percent GDP increase in 2021.

The report warns GDP growth in 2023 is predicted to be “just 1.2 percent.”

“With the exception of 2020's pandemic shock, the 2023 forecast would represent the weakest annual performance in more than a decade,” the Bank advised the Committee about growth in the developed world - which includes Canada.

In Emerging Markets the report states there is also anticipated downgrade with growth at 3.3 percent in 2022 and 3.7 percent for emerging nations in 2023. The downgraded outlook is attributed to Russia’s economic collapse in 2022.

When it comes to inflation the report warns it is expected to linger between six and eight percent for 2022 in the developed world. Inflation is set to "remain above normal in 2023, albeit meaningfully lower.”

Higher interest rates leading to lower housing prices, dialing back monetary and fiscal stimulus and a lower pace in the rise of commodity prices are seen as the factors set to calm what is called "unacceptably high inflation” in the report’s disclaimer.

The report states the opinion inflation in time will stabilize just over two percent higher than the decade pre-pandemic when inflation was just under two percent.

The Bank of Canada sees healthy inflation at two percent and strives to achieve that result through its monetary powers. Recently the Bank of Canada has started to increase interest rates to help quell high inflation.

The report stated that central banks have acted urgently in their actions to quell inflation.

“With central banks highly focused on taming inflation, they will be reluctant to turn to monetary easing even if the economy encounters a downturn,” the report warned.

It should be stated higher interest rates while combatting inflation can also lead to a reduction in demand triggering a recession.

View the entire report by Clicking Here.