Property Tax Arrears Drop Year Over Year - Trend-wise Arrears Follow Traditional Curve Upwards

By Robert Thomas

Monday afternoon’s presentation of the the City’s quarterly reports had a statistical reason to be happy - that being for June 30th this year compared to June 30th, 2021 the amount of property tax arrears has dropped by close to $500,000.

But if you remove the economic anomalies of the two years of the COVID - 19 pandemic, 2020 and 2021, statistically property tax arrears are continuing their upwards trend.

“You can see overall June 30th, 2022 compared to June 30th, 2021 our tax arrears are down almost $500,000 so we are just a little over $2,000,000 in tax arrears at the end of the second quarter,” finance director Brian Acker said in delivering the report to Council.

Council listens to the quarterly financial report - MJ Independent photo

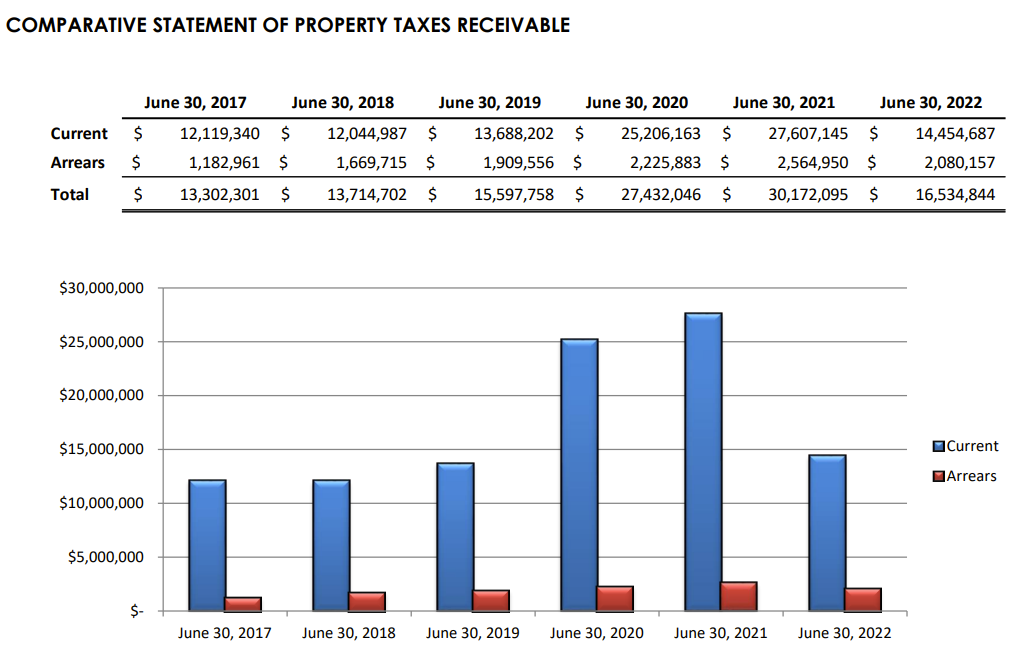

In figures released on June 30th, 2022 total property arrears (both properties with tax liens and on arrears payment plans) was $2,080,157 a reduction of $484,793 in total property tax arrears from the $2,564,950 recorded on June 30th, 2021. (See graph below).

Graph showing property tax arrears as of June 30th for 2020, 2021 and 2022 - source City of Moose Jaw

The data released also show a sharp increase in arrears payment plans from June 30, 2020 when $901,705 were in payment plans to June 30, 2021 when $1,649,202 were in arrears payment plans.

The reason for the $747,947 year over year increase in arrears payment plans was Council taking measures to ease the rules to allow delinquent property owners to get on arrears payment plans.

The easing of the rules to get on arrears payment plans was no longer offered in 2022 and as a result on June 30, 2022 there was $874,276 in arrears payment plans almost as much as on June 30, 2020 when $901,705 was in arrears payment plans.

Long Term Trend

A larger seven year snapshot of total property tax arrears shows a continual trend upwards if the two years of the COVID - 19 pandemic are removed as economic anomalies from the data.

(For a graphical representation see the chart below.)

Graph showing property taxes receivable as of June 30th (2017 - 2022) - source City of Moose Jaw

A look at the property tax receivables over the seven year period - 2017 to 2022 on June 30th - shows a major spike in both of the pandemic years (2020 and 2021) of outstanding property taxes - current year and arrears (not paid by December 31st of the year levied).

On June 30th, 2020 there was $27,432,046 in total property taxes owing a figure that increased to $30,172,095 on June 30th, 2021.

Taking the two pandemic years of 2020 and 2021 out of the statistics - because of their economic anomalies - there is a still a steady gradual climb in property tax arrears owing on June 30th in the non-pandemic years of 2017, 2018, 2019 and 2022. (See chart below)

Property Tax Arrears On June 30th 2017, 2018, 2019 and 2022

On June 30, 2017 the property tax arrears were $1,182,961 and by June 30, 2022 property tax arrear had grown to $2,080,157 a $897,196 increase over the seven year span.

On June 30, 2018 the property tax arrears were $1,669,715 compared to the $1,182,961 in property tax arrears on June 30, 2017 an increase of $486,754 year over year.

On June 30, 2019 the property tax arrears were $1,909,556 compared to the $$1,669,715 in property tax arrears on June 30, 2018 an increase of $239,841 year over year.

On June 30, 2021 the property tax arrears were $2,080,157 compared to the $1,909,556 in property tax arrears on June 30, 2018 an increase of $170,601 (after removing 2020 and 2021 from the data set due to their being economic anomalies).